A key constant in the banking, financial services and insurance industries is the always increasing expectation of digital customer experience, making this the most important factor for businesses to achieve their primary goal of increasing new prospects and retaining existing customers.

A recent survey shows that 76% of customer experience management executives and leaders rated customer experience as the highest priority.

Source: Superoffice.com

Digital adoption has increased 28% to 46% across industries over the pandemic and is expected to as organisations are now forced to create hyper-personalized experiences across digital channels.

Elevating the customer’s experience

73% of consumers say a good experience is key in influencing their brand loyalties. Digital customer experiences need to be accessible, intuitive, user-friendly, hyper-personalized, predictive, consistent across channels, and secure to exceed the expectation bar set by customers.

Research shows that there are 3 fundamental ingredients to a good digital customer experience.

- Success is measured by customer’s outcome, whether they completed the task they set out to do on the platform.

- Effortis the ease at which the customer undertook to complete the process.

- Emotion is the rating of customer’s sentiment upon completing the digital interaction.

A customer engagement statistics report shows that companies that earn US$1 billion annually can expect to earn, on average, an additional $700 million within 3 years of investing in customer experience trends, a 70% increase in revenue.

The role of technology in CX

Technology is a vital element of customer experience initiatives. Businesses can leverage on emerging technology trends to customer engagement.

In 2022 and beyond, we are bound to see the following digital customer experience trends among organisations: an omnichannel customer experience, delivering a hyper-personalized experience, transforming data into insights with predictive analytics, data-driven marketing and video marketing for a better customer experience, chatbot automation for improved CX, assisting customers in real time with visual engagement, enriching customer service with augmented reality (AR) and voice commerce, centralizing customer insights with the Internet of Things (IoT), data transparency, loyalty programs for increased customer retention and secure transactions.

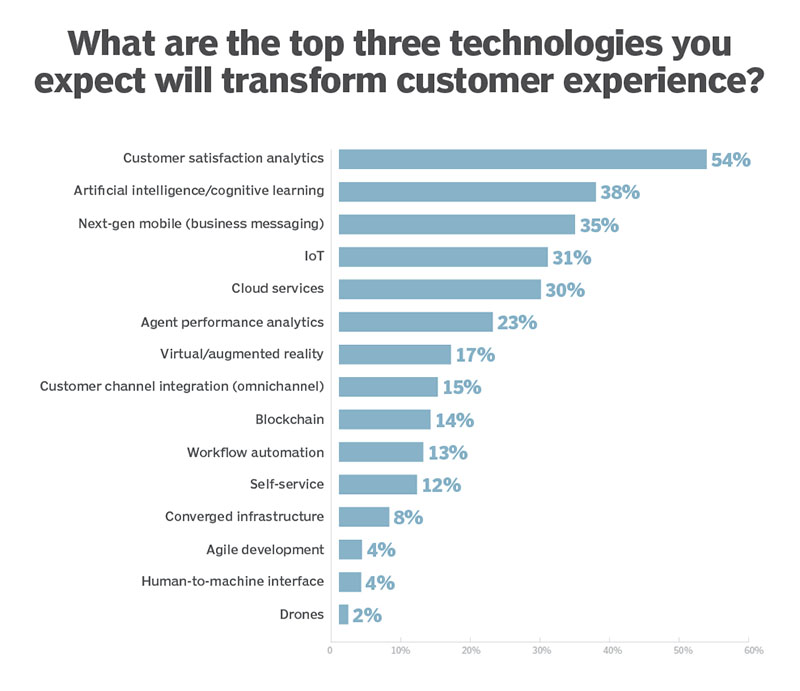

Transforming CX is high on the executive priority list. Knowing precisely which digital customer experience technologies to consider a reasonable organisational budget can be a time-consuming and overwhelming task.

Data in a recent study can help businesses narrow down technology categories to show that banks that invest in customer satisfaction analytics have higher rates of recommendation, greater wallet share, and are more likely to up-sell or cross-sell products and services to existing customers.

Source: techtarget.com

Best Practices in Digital CX

Businesses need valuable customer engagement insights to identify the latest trends and plan consumer-focused strategies for favourable business outcomes. For example, two-thirds of customers will share personal information with brands, but only in exchange for customer value and 81% of companies view customer experience as a competitive differentiator.

Some foundational steps in improving digital customer experience include:

- Knowing your audience

- Creating an omnichannel customer experience

- Personalizing mobile experiences

- Adopting big data analytics

- Collecting customer surveys and feedback

- Conducting a user testing

- Planning for future trends and outlook

Disrupting trends in Customer Experience

Coping with digital disruption can be challenging for a established organizations. Digital transformations often happen lightning fast, filling a natural vacuum in the market, such as the demand for omnichannel support or the appeal for hyper-personalized products.

Key disruptive factors can include commoditization, digital transformation, changing business models, complex service ecosystems, changing customer and workforce expectations. Although no one can predict the disruption, having a working knowledge of its contributing factors and how they impact customer experience will put you and your organization in a better position to adapt to the market for a competitive edge.

Why digital customer experience should be your ultimate goal

Studies indicate that when customers believe they receive a great digital experience, they are ultimately willing to pay more. Conversely, 58% of customers say they will switch companies due to poor customer service which are not timely, context-driven, personalized or available across preferred customer channels.

Offering a unique, flexible and memorable user experience have shown increasing sales, volumes, transactions, interactions, prospects, customer and user loyalty toward brand, a quicker time to market, operational efficiency, an improvement in the image and reputation of brands and resource utilisation, a reduction in marketing and personnel costs and complaints and finally, a conducive work environment and employee identification with the business.

The right digital customer experience strategy can help you achieve a possible increase of over 300% in the lifetime value of your customers. By helping customers to onboard customers in less than three minutes with real time interaction between financial advisors and customers across their wealth management journey, we have forged ahead as thought leaders to help clients like you to stay ahead of the competition by leveraging on the latest trends and capitalize on them at right time with the right technology and people. Together, quantifying digital customer experience for business ROI remains top priority for us partners and financial institutions alike.

Connect with us here.