How RM Assist Transform Advisory Efficiency in Wealth Management

In today’s dynamic wealth management landscape, the term “efficiency” often brings to mind basic CRMs and administrative streamlining.

But what if advisor efficiency went beyond merely tracking client interactions, truly empowering them to close deals faster, offer proactive advice, and elevate the entire client relationship?

This is where a solution like Avantrade’s RM Assist steps in, moving beyond traditional CRM functionalities to redefine what an advisor can achieve.

The Unseen Bottlenecks Hindering Deal Closure

Imagine an advisor sitting with a high-net-worth client, the conversation flowing, and the client ready to commit to a significant investment. However, due to system silos and fragmented workflows, the advisor can’t complete the transaction on the spot. They have to promise to “get back to the office” to process the purchase. This seemingly small delay often leads to a critical loss of momentum. The client’s initial enthusiasm wanes, their attention shifts, and the deal, once within reach, might never materialize. This isn’t just an administrative hurdle; it’s a direct impediment to revenue growth and client satisfaction, a silent killer of potential.

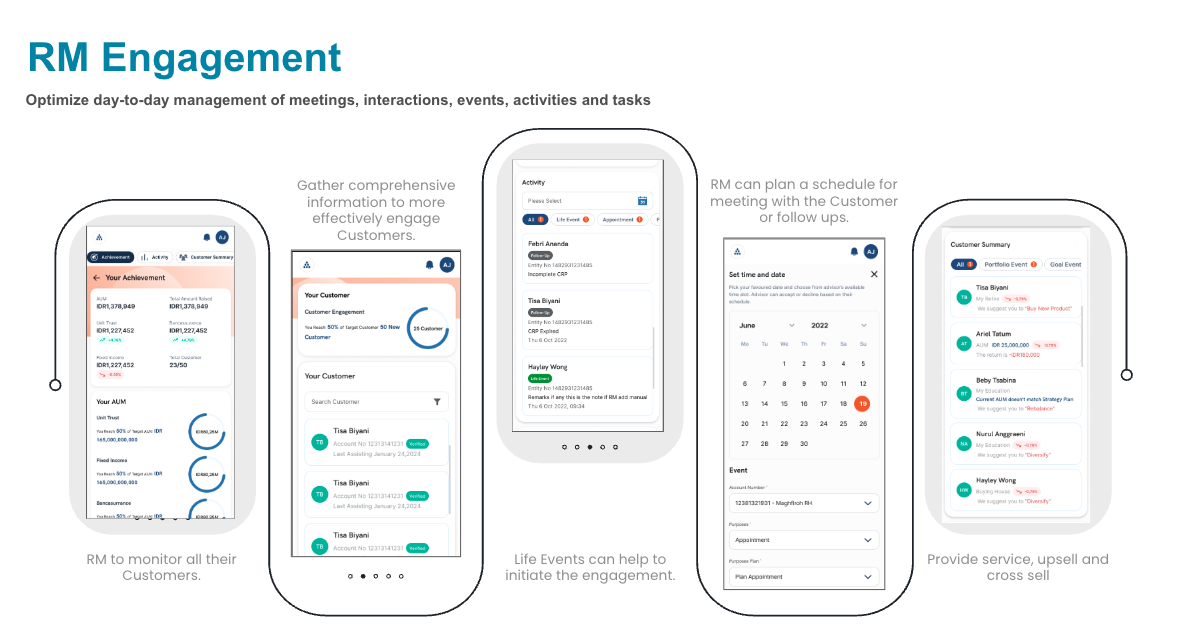

Proactive Engagement, Not Reactive Management

Traditional systems often force advisors into a reactive stance – responding to client queries or market fluctuations after they occur. RM Assist, however, fundamentally shifts this paradigm. Think about the constant volatility in asset pricing today. With RM Assist, advisors can:

- Continuously Monitor Portfolios: Instead of checking disparate systems, RMs have a unified view, allowing them to frequently monitor clients’ portfolios in real-time, instantly flagging performance deviations or opportunities amidst market shifts.

- Track Progress Towards Goals: Beyond just portfolio performance, RM Assist helps advisors track a client’s actual progress toward their stated financial goals. Is the client on track for retirement? Do they need to top up investments to meet their child’s education fund target? This clarity enables truly proactive advice, allowing RMs to initiate conversations about adjustments before a goal is jeopardized. This fosters a deeper, more trusted relationship.

The Ripple Effect: Beyond Just Saving Time

The benefits of true efficiency extend far beyond mere time savings. When an RM’s day isn’t consumed by administrative tasks and system hopping, it creates a powerful ripple effect:

- Higher Advisor Satisfaction: Less frustration, more meaningful client engagement, and faster achievement of personal goals lead to a more satisfied, engaged, and ultimately, more productive relationship manager.

- Elevated Client Experience: Clients receive timelier, more relevant advice. Their needs are anticipated, and transactions are smoother, leading to a palpable increase in customer satisfaction and loyalty.

- Accelerated Growth for the Bank: Shorter time to deal closure directly translates to faster revenue recognition. Higher AUM growth, increased competitiveness, and the ability to attract and retain top talent become direct outcomes of empowering your front-line advisors.

Seamless Operations in an Integrated World

While RM Assist excels in its core capabilities, its strength is amplified by its design for open architecture. It’s not about replacing every existing system, but rather about enhancing the ecosystem. By minimizing the need for advisors to log into separate core banking or order management systems for routine tasks, RM Assist streamlines the workflow. This allows RMs to stay within a single, intuitive environment for most of their client-facing activities, providing a holistic view without the friction of multiple logins.

Freeing the Advisor for Higher-Value Interactions

Ultimately, RM Assist isn’t just a tool for administrative tasks; it’s a strategic enabler. By automating mundane processes and providing instant access to critical client and market data, it frees up the most valuable asset a wealth management firm possesses: the advisor’s time. This liberated time can then be dedicated to what truly matters – deeper engagement, complex problem-solving, prospecting for new relationships, and providing the nuanced, human-centric advice that technology alone cannot replicate.

In an era where client expectations are sky-high and competition is fierce, equipping your advisors with an RM Assist solution goes beyond mere efficiency; it’s about transforming their capability, elevating the client experience, and securing your competitive edge in the wealth management market.